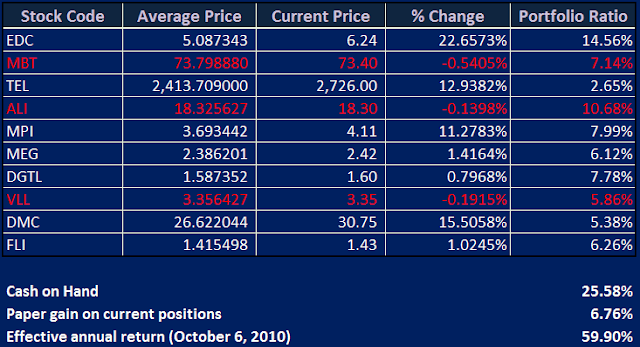

My portfolio is still bloody in spite of the 3-day rally of our market because I chased prices in the earlier phase of the big correction. And when I was 100% invested, the market was going down further and there's nothing I can do but watch. Surely, lesson is learned but I was not that worried because of some reasons. First, since there is a slight inverse correlation between our stock market and the US dollar, I'm a bit hedged by the forex because I am sending the equivalent amount of my portfolio to our peso account. Second, the lower the market is, the lower the units will be on an equity mutual fund, which we are planning to open this time on FAMI.

Here's my portfolio as of Friday's close.

An OFW who have a very limited access of information on PSE-listed companies can profitably trade/invest in the Philippine stock market.

About Me

- Kon

- The blogger is an OFW in the UAE waking up 10 minutes early to do his everyday trading. :)

Saturday, December 4, 2010

Monday, November 22, 2010

Island in the Sun

Hep hep...

http://www.youtube.com/watch?v=0C3zgYW_FAM

Hep hep... And we're on a holiday.. ^_^

Woohooo! We are to have our vacation in a few days' time and we're just sooo excited! I rarely work at site and I wasn't even minding the stock market at its trading hours. For the meantime, I want to get stock trading out of my system during this short vacation and do nothing but enjoy. Tomorrow, I'll buy anything on that spare cash, be 100% invested, and try to forget the market to as much as I can. I'll probably buy NIKL or add more AGI.

Man, I hate seeing that two-digit paper loss on ALI...

http://www.youtube.com/watch?v=0C3zgYW_FAM

Hep hep... And we're on a holiday.. ^_^

Woohooo! We are to have our vacation in a few days' time and we're just sooo excited! I rarely work at site and I wasn't even minding the stock market at its trading hours. For the meantime, I want to get stock trading out of my system during this short vacation and do nothing but enjoy. Tomorrow, I'll buy anything on that spare cash, be 100% invested, and try to forget the market to as much as I can. I'll probably buy NIKL or add more AGI.

Man, I hate seeing that two-digit paper loss on ALI...

Friday, November 19, 2010

Saturday, November 13, 2010

Weekly Report - November 12, 2010

Do you know these woodland critters?

They are the cute, innocent-looking but cruel critters in South Park led by that cuddly bear in the right who has super powers to protect the son of satan. While viewing all the bloodshed that happened the past few days in the stock market, I knew that only such a bear is capable of doing such so he should be the one responsible of slaughtering all the bulls. He may have raped them as well.

That South Park episode happily ended when Santa came, armed with his shot gun, killed all the woodland critters just before the Christmas eve.

Will our episode end the same way? Santa, please come and save us again and kill this bear and make us happy before Christmas! =)

Well, everybody is talking about this bloodshed. I for one, being an aggressive buyer on dips and not using stop loss or trailing stops, lost a pretty good sum of money. If I'll scale the profit (realized) I earned from August 'til end of October to Php100, my paper profit was around Php11 before this correction. As of today, I'm already having a paper loss of Php25. So from Php111, I'm now down to Php75.

Let's just pray that this week is the end of this bloodshed. The index already touched its 50-day MA and is already in the stochastic's oversold region.

Let's just pray that this week is the end of this bloodshed. The index already touched its 50-day MA and is already in the stochastic's oversold region.

Here's my bloody portfolio for the week:

Wednesday, November 10, 2010

REDS

If the red tide is the headline in our common news, the red bloodbath in our market is just analogous in the investing world. Since November 4's 4,397 close, our market dropped by 199.73 points or -4.54% in just a matter of few days. Being a total newbie, this is the first time I saw the market drop to such an extent. Since I still believe that our market is still bullish in general, I categorize this situation as an opportunity for bargain hunts rather than a reason for a panic and sell all my holdings while still at profit. As a matter of fact, I bought back my old high flyers and I'm 88% invested now. If I get 100% invested, I guess I don't have to wake up 10 minutes early daily to find such opportunities. :-) My strategy might be risky because it is also highly probable that the market could go down further, but if it does, then maybe we'll just inject additional funds from our active income and wait for the prices to go back. Anyway, being in our 20's, there is still a decade or two for us to wait so there should be less risk. :-)

Here's my current portfolio. I got a little overexcited so I bought stocks a bit early. ^_^

Saturday, November 6, 2010

Weekly Report - November 5, 2010

This week, I have significantly reduced my holdings due to profit taking as narrated in my November 2 diary. I also sold my CEB at a loss because of fear which I later regretted because I was able to tolerate a paper loss of 10% in my ALI and EDC but I immediately panicked in my CEB when it was just -7%. Perhaps I should set a certain percentage of loss on a position before I mechanically decide to sell at given ranges of ratios in my portfolio...

Here's my portfolio at the end of the week.

Here's my portfolio at the end of the week.

Thursday, November 4, 2010

Ctrl + Z

After my selling galore last Tuesday, most of the stocks I sold (with the exception of TEL) moved up further yesterday and today. :,( I locked my profits but I virtually lost money. And what's worse? When I reached the site yesterday, I saw CEB bottomed to 116 and I was suppose to have a stop loss at 120. I panicked so I immediately sold it at that instant at its bid price of 117.70 for it to go back again to 122.40 today. :(( So my first IPO didn't go that well. It was my second completed buy and sell where I incurred a loss (first was GMA7 last August). Well, nobody have that crystal ball to know where the prices will be heading and stock trading is a purely mechanical and non-emotional activity (let the defense mechanism work ϋ). Being 50% invested only, I'm back on standby again for a major correction. As of this writing, DOW is up by 166 (+1.48%) points due to the fed's QE2. As far as I know, DOW WAS highly correlated to our market, until having its own life recently. So the question is if our market will rally as well due to this or it will decouple since funds will be brought back to the big market.

My portfolio update:

My portfolio update:

Tuesday, November 2, 2010

Harvest Day

My greed just got satisfied today. I booked my profits on DMC, MBT, MEG, MPI, and TEL. :-) I don't know yet how much money I made because I did all the trades here at site. EDC is the only performing stock I kept for now because I still view that stock as long-term. Hopefully, FLI will also break its tough 1.44 resistance this week and be my next wonder stock, together with my other property stocks. As for CEB, I guess I will give it up to P120 and set my stop-loss there.

Again, there's a stupid hole in the PSEi's intraday value. I checked Citisec's data and if the info is correct, it should be TEL (low is 2,424) from broker 102.

Citisec is lazy enough not to post the PM report for the day again. But to wrap it up, PSEi is up by 73 points at 4,341.75 led by MBT, MEG, and AGI and foreigners are net buyers again for the seventh straight day as they acquired Php368M worth of shares.

Here's my portfolio before I sold my positions:

Here's my current portfolio:

Again, there's a stupid hole in the PSEi's intraday value. I checked Citisec's data and if the info is correct, it should be TEL (low is 2,424) from broker 102.

Citisec is lazy enough not to post the PM report for the day again. But to wrap it up, PSEi is up by 73 points at 4,341.75 led by MBT, MEG, and AGI and foreigners are net buyers again for the seventh straight day as they acquired Php368M worth of shares.

Here's my portfolio before I sold my positions:

Here's my current portfolio:

Friday, October 29, 2010

Weekly Report - October 29, 2010

I was a bit afraid to enter any new positions this week. I just don’t feel that confident lately and I don’t have a particular bullish stock in mind except for the ones I have but I don’t want to average up yet. I’m still satisfied with my current holdings and I can always wait for the right time to use my spare cash. With the exception of ALI, my red stocks are good as in their sideway movements. Too bad that ALI is my third largest holding which significantly drags down my profits.

DMC & MPI had been spectacular this week. My MPI is about to overtake my EDC now in terms of gain. I read today that GMA7’s Q3 profit was down by 26% which should be expected because political ads were already prevalent on the same period last year. I still believe that this stock will perform because of improving ratings. By the way, I made a spreadsheet before on how media stocks GMA7, GMAP, & ABS perform a few months before a national election to a certain period which is also a few months before that election. I tried to search it in my laptop but what I found is the profitability spreadsheet of different Farmville seeds per unit time :)) It may be basic but it’s interesting. Anyway, I’ll just try to make it again and post it here.

On a week on week basis, my portfolio was up by 1.06% compared to PSEi’s -0.42%. Here’s the composition of my portfolio for the week.

Thursday, October 28, 2010

A Disconnected (E)-Life

I was not able to update my blog lately for one good reason - my damn internet connection at home is gone. After waiting for a year and being able to use it for a couple of days only, my fiber optic box suddenly fails to authenticate itself to the network. Pinasabik lang ako.. :((

I just had a very small time of peeking price actions in the market from the site. On CEB's debut last Tuesday, I was about to write about it's 'high flying' first day performance but today, it's not applicable anymore. Really, I still have a lot to learn in the market. Is it possible to use the 'stabilization fund' to buy the 'over-allotment shares' to jockey up the IPO? :-) I hope on our vacation on December, we could attend a fundamental and technical analysis seminar so that I can make this blog a little more informative and device my own S.M.A.R.T. trading strategy.

I just had a very small time of peeking price actions in the market from the site. On CEB's debut last Tuesday, I was about to write about it's 'high flying' first day performance but today, it's not applicable anymore. Really, I still have a lot to learn in the market. Is it possible to use the 'stabilization fund' to buy the 'over-allotment shares' to jockey up the IPO? :-) I hope on our vacation on December, we could attend a fundamental and technical analysis seminar so that I can make this blog a little more informative and device my own S.M.A.R.T. trading strategy.

Friday, October 22, 2010

Weekly Report - October 22, 2010

Today, I woke up late and the market was already closed. :,(

Anyway, I don't have any plans of selling. I was just happy to see that most of my issues were significantly up today. I was a little frustrated after being outperformed with the big gain of the PSEi yesterday, 0.50% vs 1.36% but good thing I got a pretty good rebound today.

On a week on week basis, my overall paper gain was up by 1.24%. MBT made a good come back while my ALI seems to continue its down trend. How long shall we still wait for this freakin' REIT? I read somewhere that foreign funds are starting to lose their appetite because of this delay. Same with this PERA law (our local 401k fund), I wonder how many more years before we could benefit from it. It was already signed into a law more than 2 years ago but we're still waiting for that IRR.

Next week, Cebu Pacific will be listed and I'm excited how it will perform. :) I'm only planning to hold the stock on a short term basis. Yesterday, I tried to post a SLI at 1.95 but it went only to a low of 1.99. I wanted to range-trade it. Gambling in stocks is really tempting and it can't be helped. :)

Here's my portfolio for week.

Anyway, I don't have any plans of selling. I was just happy to see that most of my issues were significantly up today. I was a little frustrated after being outperformed with the big gain of the PSEi yesterday, 0.50% vs 1.36% but good thing I got a pretty good rebound today.

On a week on week basis, my overall paper gain was up by 1.24%. MBT made a good come back while my ALI seems to continue its down trend. How long shall we still wait for this freakin' REIT? I read somewhere that foreign funds are starting to lose their appetite because of this delay. Same with this PERA law (our local 401k fund), I wonder how many more years before we could benefit from it. It was already signed into a law more than 2 years ago but we're still waiting for that IRR.

Next week, Cebu Pacific will be listed and I'm excited how it will perform. :) I'm only planning to hold the stock on a short term basis. Yesterday, I tried to post a SLI at 1.95 but it went only to a low of 1.99. I wanted to range-trade it. Gambling in stocks is really tempting and it can't be helped. :)

Here's my portfolio for week.

Thursday, October 21, 2010

Finally, an E-Life Connection =)

'E-Life' is the FTTH (fiber-to-the-home) product/service of Etisalat, the local mobile operator here in UAE. Literally, FTTH is a (not so) new technology that connects your home directly to a single-mode fiber optic instead of the usual copper of DSL. In short, it's a super speed internet connection.

After more than a year of application (yes, I first applied for this service April of last year and this has been my third application), I finally got my connection this morning! Well, that's how monopoly works but, WOOHOOO! I was sooo deprived of downloading because my previous internet connection was data-metered which means I have a certain limit of data download per month (mine was 5GB at AED295/mo., ~Php3,500 - quite pricey but then again, that's how monopoly works) plus the connection is so slow and the ping response is very poor which means that aggressive monsters on online games will easily kill your helpless avatar because of lag and you will destroy a good game of DoTA in Garena by suddenly getting lost. Finally, I can watch Bleach, One Piece, and Naruto episodes again instead of just reading the manga, I can download all the Simpsons episodes, my incomplete SouthPark seasons and all the series and movies I want, I can play a pretty responsive DoTA Garena with my cousins in the Philippines, I can revive my assassin in pRO Valhalla, I can connect my PS3 to the PlayStation network and more. I was so excited that I can't concentrate in my work site. =)

Well, what am I getting at? Ummm.. Nothing.. Since this is a diary, I just wanted express what I feel. =)

These are actually things that I'm trying to imply. First, I want to show that I am a very usual guy who does typically immature stuff but still, I am profitably trading in the stock market with my not-so-broad knowledge. Second, I want to express that something in me worries me that I will get pretty occupied with all of these things that I won't find reading about the stock market interesting anymore. For the meantime, maybe I would just ask Kan to do the stocks homeworks while I'm getting rid of this excitement 'til magsawa ako. :)

After more than a year of application (yes, I first applied for this service April of last year and this has been my third application), I finally got my connection this morning! Well, that's how monopoly works but, WOOHOOO! I was sooo deprived of downloading because my previous internet connection was data-metered which means I have a certain limit of data download per month (mine was 5GB at AED295/mo., ~Php3,500 - quite pricey but then again, that's how monopoly works) plus the connection is so slow and the ping response is very poor which means that aggressive monsters on online games will easily kill your helpless avatar because of lag and you will destroy a good game of DoTA in Garena by suddenly getting lost. Finally, I can watch Bleach, One Piece, and Naruto episodes again instead of just reading the manga, I can download all the Simpsons episodes, my incomplete SouthPark seasons and all the series and movies I want, I can play a pretty responsive DoTA Garena with my cousins in the Philippines, I can revive my assassin in pRO Valhalla, I can connect my PS3 to the PlayStation network and more. I was so excited that I can't concentrate in my work site. =)

Well, what am I getting at? Ummm.. Nothing.. Since this is a diary, I just wanted express what I feel. =)

These are actually things that I'm trying to imply. First, I want to show that I am a very usual guy who does typically immature stuff but still, I am profitably trading in the stock market with my not-so-broad knowledge. Second, I want to express that something in me worries me that I will get pretty occupied with all of these things that I won't find reading about the stock market interesting anymore. For the meantime, maybe I would just ask Kan to do the stocks homeworks while I'm getting rid of this excitement 'til magsawa ako. :)

Labels:

OT

Monday, October 18, 2010

Update - October 18, 2010

I was just observing the prices in my watch list 15 minutes before the closing. Out of 25 issues in my list, only 3 are green (positive). I wonder what's that little 'hole' in the PSEi at around 11am... I hope anyone can shed some light here..

Anyway, here's the current composition of my portfolio. I already added Cebu Pacific since Citisec already debited my account on the few shares I purchased. If you're wondering why my average price is 126, that's because it includes the sell charge assuming that it's trading at Php125 and I sell it at that price. If you're also wondering why my effective annual return is very volatile even with slight changes in my portfolio, that's because my fund is very young. :-)

Check out my computation here.

Anyway, here's the current composition of my portfolio. I already added Cebu Pacific since Citisec already debited my account on the few shares I purchased. If you're wondering why my average price is 126, that's because it includes the sell charge assuming that it's trading at Php125 and I sell it at that price. If you're also wondering why my effective annual return is very volatile even with slight changes in my portfolio, that's because my fund is very young. :-)

Check out my computation here.

Friday, October 15, 2010

Weekly Report - October 15, 2010

It has been a hectic week for me at work so I just had a little time to peek the market. All I did this week is buy GMA7 and MBT and subscripe a few shares of Cebu Pacific's IPO. Tuesday's major correction was supposedly a good time to hunt bargains but unfortunately, because of fear, I wasn't able to buy anything. I shouldn't have been 'barat' when I posted a PNB at 60. Properties were a little battered this week before the strong rebound yesterday. MEG was the best stock for me this week after it reported a pretty good sales. As for MBT, I did not expect that a news of a stock rights offer can dilute its value to as much as 9.4%. I still believe on the strength of this stock so a took a little more shares at 69.

Anyway, here's the status of my portfolio this week.

Anyway, here's the status of my portfolio this week.

Monday, October 11, 2010

My First IPO Subscription

I have been reading a lot about Cebu Pacific's initial public offering (IPO) lately, and I guess around 80% of the comments and blogs I read say that its IPO price of Php125/share is quite expensive. 10x P/BV, 22 P/E2010, etc. Well, I don't care. :-) As a newbie, this is the first major IPO so I want to be a part of it. I just bought a few shares equivalent to 2.5% of my total portfolio so it doesn't really matter. :)

Today, I bought a few GMA7 on a rating-speculation play at 7.46 (I'm obviously a Citiseconline client). My property sector dropped sharply also today making all my property stocks (as in all) in reds. ALI just can't settle in the 18-level...

DMC continues it strength even with our market being down by 18 points. I also noticed AT, my old speculative stock surge today (no regrets!).

Friday, October 8, 2010

Weekly Report - October 8, 2010

This week has been spectacular for DMC. In just a matter of one week, it has already surpassed the profit of my long-held and favorite EDC. I'm planning to keep this stock and wait 'til the PPP convention in November. MPI was also great. It has peaked to as much as 4.13 before correcting to 3.98 today. A further correction will make me accumulate this stock next week.

Anyway, here's the weekly summary of my current holdings and profits/losses. All my holdings were up except for FLI (click here for my last week's portfolio). That's all I did this week, one sell order of SLI and peek every now and then on major price movements.

Anyway, here's the weekly summary of my current holdings and profits/losses. All my holdings were up except for FLI (click here for my last week's portfolio). That's all I did this week, one sell order of SLI and peek every now and then on major price movements.

Wednesday, October 6, 2010

A Gambler No More

Today, I was able to dispose my SLI at 2.40 with a minimal gain. I bought that stock only due to pure speculation, without having any figures whatsoever. And I guess, that's no different from gambling. :-) No wonder stock market trading is just as addicting as playing in a casino. For me, I think investing is a pure science. If there are particular people who are well known in their scientific fields like Stephen Hawkins in physics, the same should go to the science of investing where the like of Warren Buffett has emerged as (one of) the best.

Monday, October 4, 2010

Stocks Volatility

Our market was up by more than 70 points today and luckily, all of my issues were up (or that should just be normal for such a market index gain). In just a matter of one trading day, 4 out of my 6 losing stocks for weeks are now in the positive region and just two were left in reds, MBT & VLL. I believe these are strong stocks so I won't mind holding them for months. What I missed today is the rally of SLI when it reached 2.50 which happened between my travel from home to office. I was very willing to sell it at 2.40. Anyway, I made an off-hour order at 2.50. If it won't get executed, I will sell it on whatever price above 2.30 when I wake up (that would be around 10:15am Phil time). I am bearish on the stock because I don't want to be a speculative-type anymore. I want to be more of an investor rather than a gambler. :-)

Here's the status of my portfolio as at end of October 4, 2010 trading day.

I intentionally changed the color/format to put distinction from my weekly report. =)

Here's the status of my portfolio as at end of October 4, 2010 trading day.

I intentionally changed the color/format to put distinction from my weekly report. =)

Saturday, October 2, 2010

Weekly Report - October 1, 2010

My position almost remained unchanged the whole week. Because of the down trend of mining, I sold my PX and AT while still at profits. I don't know how long will my greed keep me for holding EDC much longer. I still see a clear uptrend on the stock based on technicals and fundamentals.

Friday, September 24, 2010

Weekly Report - September 24, 2010

I was out for almost a week because my wife was hospitalized. I just got a few minutes to peek into the market and do some quick trades. This week, I bought nothing but properties. Here's the composition of my portfolio as of September 14, 2010. I will be posting this report every weekend. Obviously, I have high hopes on property stocks in the mid to long term and a bit extra cautious on mining stocks.

Note:

Average price is including all the buy AND sell charges. Example, I bought TEL here at 2,385.

If you want a copy of my spreadsheet, just send me a mail at tubero.ramon@gmail.com.

Note:

Average price is including all the buy AND sell charges. Example, I bought TEL here at 2,385.

If you want a copy of my spreadsheet, just send me a mail at tubero.ramon@gmail.com.

Sunday, September 19, 2010

Back to Properties

Last Friday, we made several trades that put the majority of our portfolio back to properties. I read somewhere that it is highly probable that interest rates will be lowered in the months to come so I guess there's still some juice to be squeezed out of them. I got several SLIs and VLLs at 2.26 and 3.32, respectively.

On my wife's recommendation, I also bought some DMCs at 26.30. Why? Because she likes its graph, qualitatively (another woman's intuition).

We are now 76% invested with a 46.2% effective annual return.

On my wife's recommendation, I also bought some DMCs at 26.30. Why? Because she likes its graph, qualitatively (another woman's intuition).

We are now 76% invested with a 46.2% effective annual return.

Thursday, September 16, 2010

It's the "In"

The past two days, I'm in a scenario where all works at site were urgent and I'm limited to 3 MB of data per day at home (this 3MB is equivalent to a 15-minute access on Citisec and a couple of blogs). My application for a fibre optic connection is pending for almost a month now. Well, combine that with a non-cooperative office and knowing that the market is still bullish while having 70% cash on hand with something inside me that I should buy something and not to be left by the rapidly rising market, I bought some stocks at pure speculation. Sumabay lang sa uso.. :-) My first mining stocks, PX and AT, were both bought at 13 something while I got DGTL at 1.57. I shouldn't have been a kuripot when I tried buying this stock when it was around 1.39 to 1.42 (it's really difficult to be a true emotionless ninja in stock trading). If EDC, FGEN, and MPI corrects further tomorrow, I would probably buy back some.

I still got 41% cash to spare.

My effective annual return lowered to 48%.

I still got 41% cash to spare.

My effective annual return lowered to 48%.

Tuesday, September 14, 2010

Missed Bargains

When I woke up at 6:25am (10:25am Phil time), the market was down for around 20 points. I noticed in the intraday chart that after crossing the 4,000 mark, the market was sharply going down. Expecting that the market will correct further, I decided to delay my buying and do it before the closing in my site office. Unluckily, we got through a minor road accident. The police arrived in our scene after 40 minutes and another 40 minutes for them to investigate and do their accident report. When I reached the site, it was already 8:30. I immediately checked the market, and to my surprise, the market just went sideways and closed 0.11% lower. In short, I missed some bargains. I was supposed to buy back BPI, MBT, and more ALI. Well, I hope that that accident is a blessing in disguise for me to buy them cheaper tomorrow. :-)

Monday, September 13, 2010

Unstoppable!

Wheeww! PSEi at 3,972.60!

In spite of being over bought last week, it continues to be "over" overbought. Happy with my profits, I reduced some of my positions again, thus reducing my holdings to 35% (and still waiting for a major correction). I sold most of my EDCs at 5.40 and bought some ALIs at 18.34 when I left home only to find out that they closed at 5.50 and 18.14, respectively, when I reached the office. Well, there are no regrets as I'm satisfied with my profits and it's one of my main rule to be mechanical and not emotional on any of my trade decisions. :-) My profits are now at 51.6% effective annual rate.

For those who are playing DoTA, I guess all will agree that our market is simply UNSTOPPABLE.

Will it reach the GODLIKE state at 5,000 level? I'm keeping my fingers crossed... :-)

In spite of being over bought last week, it continues to be "over" overbought. Happy with my profits, I reduced some of my positions again, thus reducing my holdings to 35% (and still waiting for a major correction). I sold most of my EDCs at 5.40 and bought some ALIs at 18.34 when I left home only to find out that they closed at 5.50 and 18.14, respectively, when I reached the office. Well, there are no regrets as I'm satisfied with my profits and it's one of my main rule to be mechanical and not emotional on any of my trade decisions. :-) My profits are now at 51.6% effective annual rate.

For those who are playing DoTA, I guess all will agree that our market is simply UNSTOPPABLE.

Will it reach the GODLIKE state at 5,000 level? I'm keeping my fingers crossed... :-)

Sunday, September 12, 2010

Eid Mubarak!

It's a long weekend here in the middle east because of the ending of the holy month of Ramadan. The weather is still uncomfortable, yet it's still nice to go out on the beach and relax for a bit...of course, with a little time to ponder about our stocks... :-)

DOW has been up for 75 points since PSE's last trading day. I wonder if our market will decouple and finally enter a healthy correction OR it will continue its strength and break the 4,000 psychological resistance... Either way, being 45% invested only, I will be fine on both outcomes. If the market continues its uptrend, I will sell if I achieve my target profit, and if it's down, I'll hunt the bargains. Well, I still believe our market is still bullish in the mid to long term so I won't mind being 100% invested again. :-)

DOW has been up for 75 points since PSE's last trading day. I wonder if our market will decouple and finally enter a healthy correction OR it will continue its strength and break the 4,000 psychological resistance... Either way, being 45% invested only, I will be fine on both outcomes. If the market continues its uptrend, I will sell if I achieve my target profit, and if it's down, I'll hunt the bargains. Well, I still believe our market is still bullish in the mid to long term so I won't mind being 100% invested again. :-)

Thursday, September 9, 2010

Where's the Bargain?

Seems like I'm wrong with my hunch. I ended up selling more of my holdings. I am only 44% invested now. My return is now 49% so I almost ended up selling all my stocks. Actually, I posted all of them at their peaks but only a few of them were executed. I sold my MEG, MBT, and FPH with 11.5, 9.9, & 9.7% net profits, respectively. I'm now left with four stocks, EDC, FGEN, TEL, and MPI. I believe the three of these (with the exception of TEL) will perform more in the weeks to come so I didn't force to sell them today.

I'm still waiting for that healthy correction!

I'm still waiting for that healthy correction!

Wednesday, September 8, 2010

Another Forced Close?

Another roller coaster day for the market, opening up weak in the opening ending up strong at the end. I dunno if this is still done by foreign investors forcing the market to end strong or just a coincidence happening two days in a row.

As usual, I'm a bear when everyone else is a bull. I'm also expecting a correction tomorrow because the market peaked again and there is another long weekend ahead. I happily sold my PNB at 47.80 with a net return of 15.6% and my BPI at 54 with 11.28%. I held these two stocks for around 2 weeks only. My stocks are now returning 42.7% effective annually with 35% cash on hand.

I'm planning to buy back some blue chips tomorrow if a significant bargain is there, or sell all my stocks anytime when my target of 50% effective annual return is achieved. :-)

Tuesday, September 7, 2010

Who's the Witch?

I wonder who bought a bunch of ALI's at 18.00. Is it another broker error? Man, this stock might have a curse... Anyone who have bought this stock at 14.00 two weeks ago due to an ATR Kim-Eng broker error and sold it today at 18 is one lucky fellow (or probably the witch who made the curse). :-)

Our Motivation

Even before I started investing, I am already an active saver. Or probably let’s just say that I don’t really fancy a lot of stuff and buy unnecessary things. My wife and I log all our monthly expenses not only for budget purposes but also to highlight the major expenses that we have paid for. We save more than 20% of our income per month. However, we know that merely saving is not enough to achieve our financial stability sooner.

Then came the recession that made a direct impact in the UAE where a lot of construction-related companies went bankrupt. What happened was like the survival of the fittest. Weak and newly established companies either closed or merged with stronger allies. Other companies restructured by laying-off staff or cutting expenditures by lowering salaries. We were just married then and my wife was one of those who were terminated because of company closure. The first thing we did was to pay off the remaining balance of her car loan with her separation pay. (Cutting off outstanding liabilities)

As she spent her time looking for a new job, she also got in touch with her former college friends who got to share with her their investments. She also motivated me to read books like Robert Kiyosaki’s Rich Dad Poor Dad and Bo Sanchez’ Secrets of the Truly Rich. We also tried FX trading by opening a sample account just for learning purposes. At the end of the day, we usually discuss investment strategies, business ideas, insurance, retirement and other new things that we have uncovered. We accepted certain realization that inspired us to take a step towards exploring the world of investing and securing our future.

Here is the list that became our motivation:

1. In the future lies many uncertainties. It is either you accept this fact or face the consequences by being ignorant. If you don’t plan well you might end up just wishful thinking.

2. We don’t want to end up like the other OFWs who retire without any investments or probably with some savings that would only last for a year or two.

3. We don’t want to be trapped in the rat race forever. We want to retire early and spend more time with the family while having a stable source of income to last our lifetime.

4. Speaking of “lasting our lifetime”, we don’t want to be a burden to our future children when we get old. Our goal on financial stability doesn’t end when our kids graduate from college. We intend to have our retirement plan to last our lifetime, literally.

5. Putting all your savings in the bank is like giving full charity to the bank.

6. Risk more while you are young. The greater the reward, the greater the risk. Risk wisely.

7. Avoid buying pseudo “assets”. It is only accumulating liabilities, not assets. Know the difference between “needs” and “wants.”

8. Multiply your blessings. Share whatever you can whenever you have the opportunity to share. However, there is always a boundary between giving a man a fish and teaching him how to fish.

Well, that’s how everything begins, having the motivation and proper mind set.

Labels:

The Motivation

Subscribe to:

Posts (Atom)