I was a bit afraid to enter any new positions this week. I just don’t feel that confident lately and I don’t have a particular bullish stock in mind except for the ones I have but I don’t want to average up yet. I’m still satisfied with my current holdings and I can always wait for the right time to use my spare cash. With the exception of ALI, my red stocks are good as in their sideway movements. Too bad that ALI is my third largest holding which significantly drags down my profits.

DMC & MPI had been spectacular this week. My MPI is about to overtake my EDC now in terms of gain. I read today that GMA7’s Q3 profit was down by 26% which should be expected because political ads were already prevalent on the same period last year. I still believe that this stock will perform because of improving ratings. By the way, I made a spreadsheet before on how media stocks GMA7, GMAP, & ABS perform a few months before a national election to a certain period which is also a few months before that election. I tried to search it in my laptop but what I found is the profitability spreadsheet of different Farmville seeds per unit time :)) It may be basic but it’s interesting. Anyway, I’ll just try to make it again and post it here.

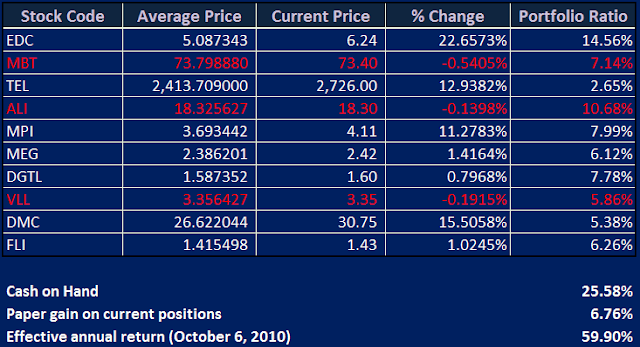

On a week on week basis, my portfolio was up by 1.06% compared to PSEi’s -0.42%. Here’s the composition of my portfolio for the week.